Monetizing Foreign VAT Reclaim for Business Customers

Foreign business expenses (Basics of the VAT refund procedure).

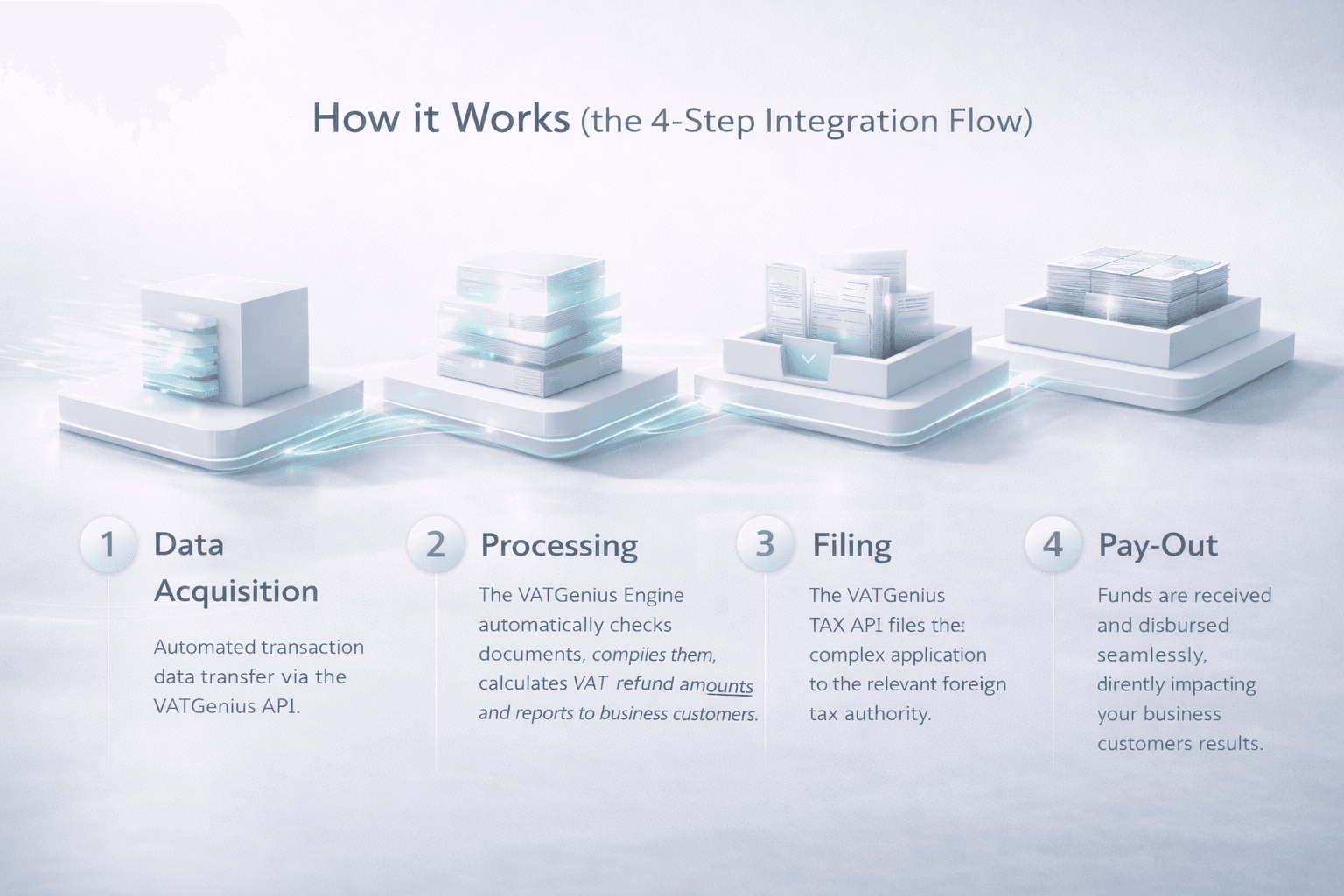

Our Solution: Elevating customer value and generating passive revenue through a fully automated, compliance-assured platform for B2B VAT recovery, requiring zero effort from your business customer.

Your Customer Benefit

No Effort

Fully automated identification of refundable VAT.

Maximum Amount

AI-supported verification ensures the full potential of VAT refunds.

Complete Transparency

Access the status of the application at any time via the banking dashboard.

Compliance & Security: Trust Built on Regulatory Excellence

As a partner in the financial sector, we understand that trust, security, and uncompromising regulatory adherence are non-negotiable. Our solution is engineered to mitigate risk, ensuring full compliance for both your institution and your business customers.

Global Tax Compliance-as-a-Service

- Dedicated Expertise:International tax specialists managing all relevant regulations

- Risk Transfer:Offload the entire regulatory burden to us

- Audit Readiness:Fully auditable and defensible claims

Data Security and Privacy (GDPR Compliant)

- Zero-Trust Architecture:AES-256 encryption at rest and TLS 1.2+ in transit

- Data Minimization:Only necessary data processed per GDPR

- Regular Audits:Independent third-party security audits (SOC 2 readiness)

Secure API and Infrastructure

Our integration is designed to integrate seamlessly without compromising your existing security posture.

Token-Based Authentication

Secure API interactions

Cloud Infrastructure

Certified environments with redundancy

Ready to Get Started?

See how VATGenius can help your business customers recover foreign VAT.